On February 20, 2026, the U.S. Supreme Court ruled 6-3 that President Trump exceeded his authority by using the International Emergency Economic Powers Act (IEEPA) to impose broad tariffs, holding that the law’s language to “regulate… importation” does not encompass tariffs or duties, as it lacks explicit authorization for such revenue-raising measures. The decision applies only to IEEPA-based tariffs (invalidating a significant portion of those imposed since April 2025), leaving other statutory authorities intact and emphasizing that Congress must clearly delegate tariff powers with limits and procedures. Trump administration officials have indicated they plan to pivot to these alternatives to reinstate or impose similar tariffs. rHere are the primary legal pathways available, based on existing trade laws: 1. Section 232 of the Trade Expansion Act of 1962 (19 U.S.C. §1862) Allows the President to impose tariffs or quotas on imports that threaten national security, following an investigation by the Department of Commerce (often involving the Department of Defense). Trump used this extensively in his first term (e.g., on steel and aluminum) and has already applied it to sectors like automobiles, semiconductors, and timber in his current term, with ongoing probes into critical minerals, drones, and robotics. No explicit rate caps, but actions must be tied to security findings; upheld by the Court in prior cases like Algonquin SNG, Inc. v. Federal Energy Administration (1976). Investigations typically take 270 days but can be expedited. Potential: Broad applicability, but requires evidence of security threats, opening it to legal challenges if overly expansive. 2. Section 301 of the Trade Act of 1974 (19 U.S.C. §2411) Authorizes the U.S. Trade Representative (USTR) to impose tariffs in response to foreign countries’ unfair, unreasonable, or discriminatory trade practices that burden U.S. commerce. Commonly used against China (e.g., for IP theft), with current investigations into China’s semiconductors, shipbuilding, and logistics sectors. Explicitly allows “duties or other import restrictions.” Process involves investigations (up to 12 months), consultations, and public hearings; no fixed rate limits, but actions must be proportionate. Potential: Flexible for targeted retaliatory tariffs, but time-consuming and subject to WTO disputes or domestic lawsuits if procedures are skipped. 3. Section 201 of the Trade Act of 1974 (19 U.S.C. §2251) Provides “safeguard” tariffs or quotas to protect domestic industries from surges in imports causing serious injury, regardless of fairness. Requires an International Trade Commission (ITC) investigation (up to 120-150 days) and findings of injury; tariffs can last up to 4 years initially, with extensions. Explicitly references “duties” and includes safeguards like hearings. Used sparingly (e.g., by Bush on steel in 2002). Potential: Useful for broad import relief, but limited to injury-based cases and often leads to foreign retaliation. 4. Section 122 of the Trade Act of 1974 (19 U.S.C. §2132) Permits temporary import surcharges (tariffs) to address large, persistent balance-of-payments deficits or to prevent imminent dollar depreciation. Capped at 15% and limited to 150 days without congressional approval; no investigation required. Used by Nixon in 1971 (10% surcharge). Potential: Quick to implement for short-term relief, but restrictive duration and scope could invite challenges if deficits aren’t clearly demonstrated. 5. Section 338 of the Tariff Act of 1930 (19 U.S.C. §1338) Authorizes duties up to 50% on imports from countries imposing unreasonable burdens or discriminations against U.S. commerce, if targeted at the U.S. No investigation needed, but untested (never invoked). Potential: Broad for reciprocal actions, but high risk of litigation due to vagueness and lack of precedent. 6. Antidumping and Countervailing Duties (Title VII of the Tariff Act of 1930) Administered by Commerce and ITC to counter dumped (below-fair-value) or subsidized imports causing material injury. Case-by-case, product-specific; rates calculated based on margins (no fixed caps). Process: Petitions from industry, investigations (up to 280 days), but can be self-initiated by Commerce. Potential: Effective for targeted protections, but slower and narrower than broad tariffs. 7. Congressional Legislation Trump could seek new laws from Congress to explicitly authorize tariffs (e.g., via the Reciprocal Trade Act, proposed in his first term). No procedural hurdles from the executive side, but requires bipartisan support in a divided Congress. Potential: Most durable option, but politically challenging and time-intensive. These alternatives generally require more procedural steps (e.g., investigations, evidence) than IEEPA, potentially delaying implementation by months, and could face new legal challenges under doctrines like major questions or nondelegation. The ruling may lead to refunds for invalidated IEEPA tariffs (estimated at $175+ billion in revenue at risk), but the administration could offset losses by accelerating alternatives or offering credits instead. U.S. Treasury Secretary Scott Bessent told Reuters in January that the Treasury can easily cover any tariff refund. Trump administration officials told Reuters that they would switch to alternative tariff authorities to restore tariffs if the Supreme Court struck down IEEPA tariffs. MacDailyNews Take: Overall, this shifts tariff policy, potentially moderating broad economic impacts while allowing more targeted measures by President Trump. Support MacDailyNews at no extra cost to you by using this link to shop at Amazon. The post SCOTUS strikes down IEEPA tariffs; President Trump expected to pivot to proven trade laws like 232 and 301 appeared first on MacDailyNews. You're currently a free subscriber to MacDailyNews. For the full experience, upgrade your subscription. |

Friday, February 20, 2026

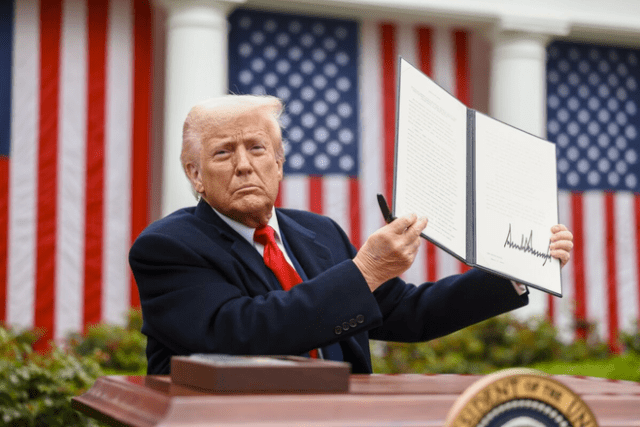

SCOTUS strikes down IEEPA tariffs; President Trump expected to pivot to proven trade laws like 232 and 301

Subscribe to:

Post Comments (Atom)

Glen Powell, Paranormasight, Scrubs, TMNT x MTG

View in browser Film TV Gaming Anime Comics We now have subscriber benefits!...

-

Substack is covering the cost of your first paid month of MacDailyNews by MacDailyNews. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Thank you for reading MacDailyNews. As a token of our appreciation, we're offering you a limited-time offer of 20% off a paid subscript...

-

Apple, aiming push more urgently into the smart home market, is said to be nearing the launch of a new product category: a wall-mounted disp...

No comments:

Post a Comment