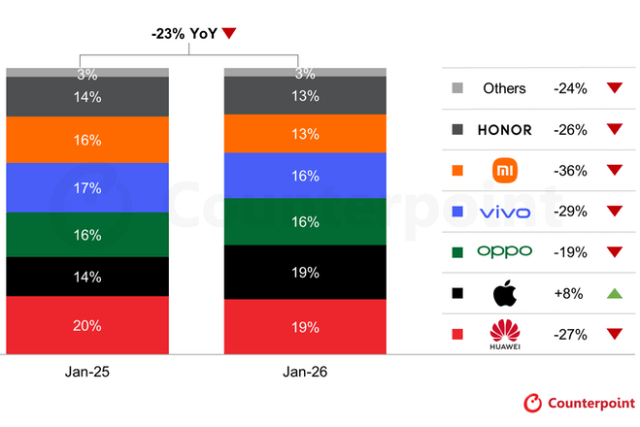

China’s smartphone sales declined 23% YoY in January 2026, largely due to a high base last year and a shift in Lunar New Year promotions timing. Driven by the continuously strong traction for the iPhone 17 series, Apple stood out as the only major brand to achieve YoY growth. Its market share reached the highest January level in the past five years. Chinese brands saw double-digit YoY declines, primarily due to a high base from subsidy-fueled demand in early 2025 and a shift in the timing of the Lunar New Year. Last year, the subsidy launched on January 20 coincided with the Lunar New Year promotion period, pulling demand forward and creating an exceptionally high base, while Apple was less affected as most of its models were not eligible for the subsidy. This year, lower subsidy intensity and weakening stimulus amid subdued consumer sentiment have limited demand recovery. Apple stood out as the only major brand to achieve YoY growth and its market share reached the highest January level in the past five years, with the iPhone 17 series sustaining strong momentum. The iPhone 17 base version now qualifies for government subsidies, boosting its value-for-money appeal and driving a 9% MoM sales increase. Price cuts for the iPhone 17 series have been relatively modest so far, leaving room for further price adjustments or margin optimization ahead of the next-generation launch to support lifecycle sales. China Smartphone Sales by OEM Share and Growth, Jan 2025 vs Jan 2026 Huawei retained the leading position in January with a 19% market share, despite a 27% YoY decline in sales. The Nova series underperformed compared to last year, while the base Mate 80 model was Huawei’s top-selling model in January. Leveraging the subsidy period, Huawei intensified its trade-in promotions by offering the highest evaluated trade-in prices across different recycling platforms, combined with an additional 20% official upgrade subsidy for new device purchases. These measures helped the brand maintain its overall sales level to some extent. Other brands have yet to officially enter the promotional season. The market is still facing weak demand, despite the availability of subsidies. We expect a more noticeable sales uptick in February, driven by seasonal buying behavior around the Lunar New Year, historically one of the peak periods for smartphone purchases in China. Support MacDailyNews at no extra cost to you by using this link to shop at Amazon. The post Apple’s iPhone market share in China reached the highest January level in the past five years appeared first on MacDailyNews. You're currently a free subscriber to MacDailyNews. For the full experience, upgrade your subscription. |

Friday, February 13, 2026

Apple’s iPhone market share in China reached the highest January level in the past five years

Subscribe to:

Post Comments (Atom)

Apple’s iPhone market share in China reached the highest January level in the past five years

China’s smartphone sales declined 23% YoY in January 2026, largely due to a high base last year and a shift in Lunar New Year promotions tim...

-

Substack is covering the cost of your first paid month of MacDailyNews by MacDailyNews. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Thank you for reading MacDailyNews. As a token of our appreciation, we're offering you a limited-time offer of 20% off a paid subscript...

-

Apple, aiming push more urgently into the smart home market, is said to be nearing the launch of a new product category: a wall-mounted disp...

No comments:

Post a Comment