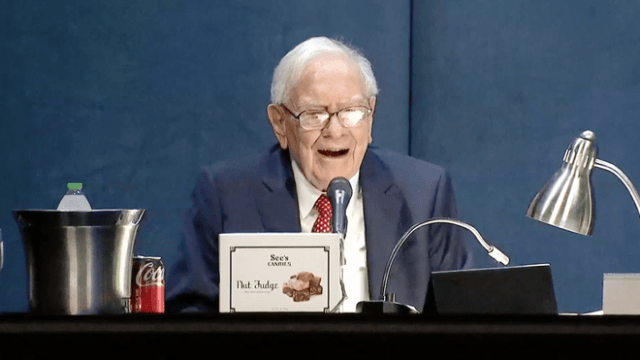

For the third quarter, Warren Buffett’s Berkshire Hathaway reported 46 holdings, but its portfolio is quite top heavy with 238,212,764 shares of Apple accounting for 21.2% of Berkshire’s portfolio. Berkshire Hathaway’s top five largest holdings:

Stefon Walters for The Motley Fool:

Assuming sales were spread across quarters at average prices during each sale period (based on reported data and historical averages): • Q2 sales (20 million shares): Average price ~$228.50 → Proceeds: ~$4.57 billion. • Q3 sales (41.8 million shares): Average price ~$225 → Proceeds: ~$9.405 billion. Total Buffett left on the table by selling Apple shares this year: ~$3.145 billion (or ~$3.1–3.2 billion, excluding dividends on unsold shares, which Berkshire would have received anyway). This is conservative; if sales occurred earlier in each quarter at lower prices (e.g., Q3 lows near $202), the figure could exceed $4 billion. Support MacDailyNews at no extra cost to you by using this link to shop at Amazon. The post Apple tops Warren Buffett’s biggest stock holdings; accounts for 21.2% of Berkshire Hathaway’s portfolio appeared first on MacDailyNews. You're currently a free subscriber to MacDailyNews. For the full experience, upgrade your subscription. |

Monday, December 1, 2025

Apple tops Warren Buffett’s biggest stock holdings; accounts for 21.2% of Berkshire Hathaway’s portfolio

Subscribe to:

Post Comments (Atom)

Glowing acclaim: ‘Shrinking’ season 3 on Apple TV racks up stellar reviews

As “Shrinking” returns for its third season on Apple TV, premiering January 28, 2026, critics are once again praising the series for its mas...

-

Apple, aiming push more urgently into the smart home market, is said to be nearing the launch of a new product category: a wall-mounted disp...

-

Substack is covering the cost of your first paid month of MacDailyNews by MacDailyNews. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Thank you for reading MacDailyNews. As a token of our appreciation, we're offering you a limited-time offer of 20% off a paid subscript...

No comments:

Post a Comment