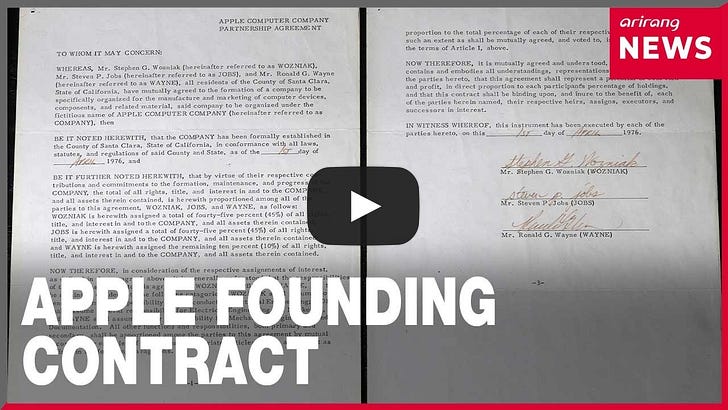

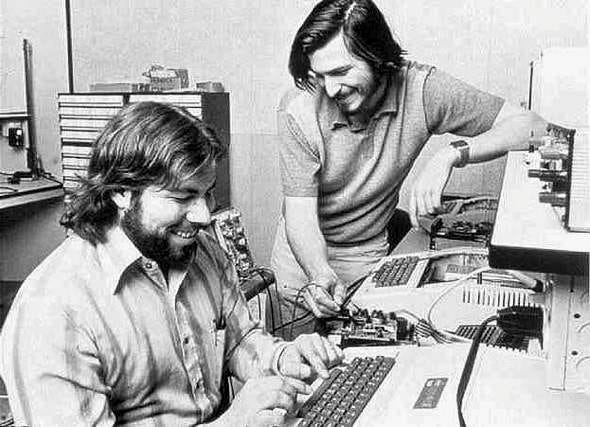

In the annals of tech history, few stories rival the scrappy origins of Apple Inc. Picture this: It’s April 1, 1976 — April Fool’s Day, no les — and two Steves, Jobs and Wozniak, along with a third partner named Ron Wayne, are scribbling signatures on a three-page partnership contract in a nondescript room. That simple document birthed the Apple Computer Company, a venture that would go on to revolutionize personal computing, redefine entertainment, and propel a garage startup into a $4 trillion behemoth. Fast forward nearly 50 years, and those very papers are set to hit the auction block again, potentially fetching up to $4 million. At the heart of this auction lot is the original partnership agreement, a modest three-page affair typed up and signed by Jobs, Wozniak, and Wayne. It laid out the basics: 45% ownership for Jobs, 45% for Wozniak (the engineering wizard behind the Apple I), and a cautious 10% for Wayne, who handled the administrative and design side. But that’s not all. The package also includes the paperwork from Wayne’s swift exit—signed just 12 days later—where he cashed out his stake for a total of $2,300 ($800 upfront and $1,500 more shortly after).  Ron Wayne. The unsung third founder whose decision to bow out remains one of Silicon Valley’s most tantalizing hypotheticals. In a recent reflection, Wayne himself summed it up perfectly: “I knew it would be a roller coaster, and that high-stakes ride wasn’t for me.” At 41 years old when Apple was formed, he was the elder statesman to the 21-year-old Jobs and 25-year-old Wozniak — experienced from stints at Atari and Hewlett-Packard, but wary of the volatility ahead. He worried about personal liability if the startup tanked, and with good reason: Early days were lean, funded by selling Jobs’ VW bus and Wozniak’s HP calculator. If Wayne had held onto his 10% stake through Apple’s meteoric rise (accounting for splits and issuances), it’d be worth around $409 billion. Wayne did cash in on memorabilia later—selling the contract copy for $500 in the 1990s and other items piecemeal, but he’s philosophical about it, often quipping that he’s “the luckiest guy who missed out.” This isn’t the first rodeo for Apple’s origin story at auction. Back in December 2011, Sotheby’s sold a similar set—including Wayne’s withdrawal docs — to a private collector for a cool $1.6 million. That buyer, it turns out, is circling back to Christie’s on January 23, 2026, to let the lot go as a single package. Experts peg the value at $2-4 million, a testament to how Apple’s cultural cachet has only grown. These papers aren’t just relics; they’re the seed of a company that’s woven itself into the fabric of modern life. MacDailyNews Take: Apple didn’t start with venture capital war chests or unicorn valuations — it started with three guys pooling dreams in a Los Altos garage. Jobs’ charisma, Wozniak’s genius, and Wayne’s prudence formed a perfect, if fleeting, storm. It’s a narrative that inspires every bootstrapped founder today: Success isn’t predestined; it’s forged in unlikely alliances and tough calls. Support MacDailyNews at no extra cost to you by using this link to shop at Amazon. The post Apple’s founding papers head back to auction, could fetch $4 million appeared first on MacDailyNews. You're currently a free subscriber to MacDailyNews. For the full experience, upgrade your subscription. |

Wednesday, November 26, 2025

Apple’s founding papers head back to auction, could fetch $4 million

Subscribe to:

Post Comments (Atom)

‘Trying’ is one of Apple TV’s sweetest treats

Last May, Apple TV announced a fifth season renewal for acclaimed comedy series “Trying,” starring BAFTA Award nominee Esther Smith and SAG ...

-

Substack is covering the cost of your first paid month of MacDailyNews by MacDailyNews. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Thank you for reading MacDailyNews. As a token of our appreciation, we're offering you a limited-time offer of 20% off a paid subscript...

-

Apple, aiming push more urgently into the smart home market, is said to be nearing the launch of a new product category: a wall-mounted disp...

No comments:

Post a Comment