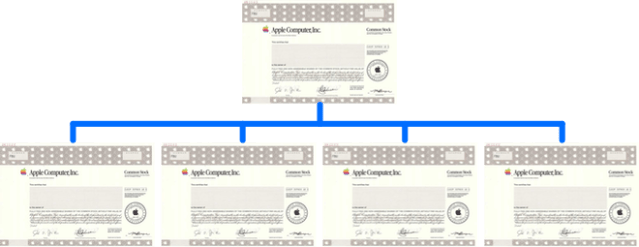

Apple, once the world’s most valuable company, now down to third place behind Nvidia and rival Microsoft, has faced a challenging 2025, with its stock declining 20% year-to-date, underperforming the S&P 500’s modest 0.2% gain. This lag, driven by concerns over antitrust issues, tariffs, competition in China, and slow-to-no progress in generative AI (GenAI), has sparked discussions about strategic moves to restore investor confidence. One such move could be a stock split, a tactic Apple has employed multiple times in its history (1987, 2000, 2005, 2014, and 2020). A stock split in 2025 could signal executives’ confidence in Apple’s long-term growth, make shares more accessible to retail investors, and position the company to attract new investment in a down year. A stock split reduces the price per share by increasing the number of shares outstanding, without altering the company’s market capitalization or an investor’s total holdings value. For example, a 4-for-1 split, like Apple’s in 2020, would divide the share price by four while quadrupling the number of shares. Apple’s stock, trading at around $200, would drop to $50 after a 4-for-1 split, making it more affordable for retail investors. This accessibility is critical, as retail investors, empowered by platforms like Robinhood, play an increasingly significant role in market dynamics. Lower share prices can broaden Apple’s shareholder base, boosting liquidity and demand. Beyond accessibility, and even more importantly as the ability to purchase fractional shares has now become widespread, a stock split would signal Apple’s confidence in its future. The company’s 2025 struggles — particularly its lag in GenAI compared to rivals like xAI, OpenAI, Google, and Anthropic — have fueled widespread investor skepticism. Apple’s AI efforts, centered on Apple Intelligence and Siri, remain starkly uncompetitive in generative tasks, contributing to a lack of confidence in the company and fueling its stock price decline. A split would project optimism, suggesting Apple anticipates strong growth, especially as it prepares to unveil iOS 26, macOS 26, and other operating system updates at WWDC 2025 on June 9th. These OS and other announcements (new AI partnerships) could align with a split to boost positive sentiment. Historically, Apple’s splits have coincided with periods of growth or recovery. The 2020 4-for-1 split followed a strong rally, making shares more accessible during a retail investing boom. Post-split, Apple’s stock rose significantly, driven by optimism around 5G iPhones and services growth. A 2025 split could similarly reassure investors, countering concerns about antitrust scrutiny or China’s competitive pressures. Critics might argue that stock splits are cosmetic, as they don’t alter fundamental value. However, the psychological impact is undeniable. Lower share prices attract retail investors, who perceive the stock as “cheaper,” driving demand. Institutional investors, too, may view a split as a proactive move. With Apple’s huge cash reserves, it has the financial flexibility to invest in AI, counter tariffs, and navigate legal challenges, reinforcing the case for a split to project confidence and stability. Moreover, a split could help Apple regain momentum among the “Magnificent Seven” tech stocks, where it currently trail by a significant margin. By making shares more accessible and signaling confidence, Apple could attract new investors, stabilize its stock price, and set the stage for a rebound. As WWDC 2025 approaches, a stock split could be a strategic move to reassure users, investors, and Wall Street analysts and position Apple shares for a stronger 2025, ahead of significant AI releases expected in 2026. MacDailyNews Take: Even just a 2-for-1 split would signal confidence on the part of Apple’s management. MacDailyNews Note: Apple has executed five stock splits in its history as a publicly traded company: June 16, 1987: 2-for-1 Split June 21, 2000: 2-for-1 Split February 28, 2005: 2-for-1 Split June 9, 2014: 7-for-1 Split August 31, 2020: 4-for-1 Split Support MacDailyNews at no extra cost to you by using this link to shop at Amazon. The post Apple might consider a stock split in 2025 to signal confidence and attract investors appeared first on MacDailyNews. You're currently a free subscriber to MacDailyNews. For the full experience, upgrade your subscription. |

Tuesday, June 3, 2025

Apple might consider a stock split in 2025 to signal confidence and attract investors

Subscribe to:

Post Comments (Atom)

Apple needs a killer AI Siri to fuel upgrades from older iPhones

Apple long ago missed its deadline for launching an AI-supercharged Siri, but the company now says it’s finally on track to deliver the upgr...

-

Substack is covering the cost of your first paid month of MacDailyNews by MacDailyNews. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Apple, aiming push more urgently into the smart home market, is said to be nearing the launch of a new product category: a wall-mounted disp...

-

Thank you for reading MacDailyNews. As a token of our appreciation, we're offering you a limited-time offer of 20% off a paid subscript...

No comments:

Post a Comment