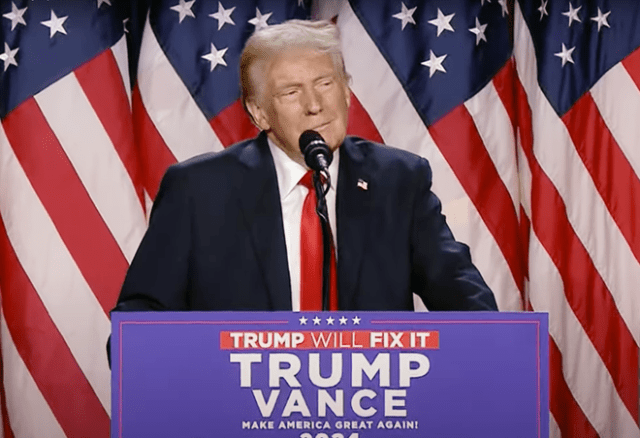

U.S. stocks are extending their lead over global peers and some investors believe that dominance could grow with the return of President-elect Donald Trump’s economic and foreign policies.

We are currently about 1/4th of the way to being sustainable with Substack subscriptions. Please tell your Apple-loving friends about MacDailyNews on Substack and, if you’re currently a free subscriber, please consider $5/mo. or $50/year to keep MacDailyNews going. Just hit the subscribe button. Thank you! Invite your friends and earn rewardsIf you enjoy MacDailyNews, share it with your friends and earn rewards when they subscribe. |

Friday, November 22, 2024

President Trump’s return could extend US stocks’ dominance over global rivals – Reuters

Subscribe to:

Post Comments (Atom)

Apple stock is Big Tech’s ‘safe haven’

Apple’s shares outperformed every other Magnificent Seven stock on Tuesday, underscoring investors’ growing preference for the company amid ...

-

Substack is covering the cost of your first paid month of MacDailyNews by MacDailyNews. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Thank you for reading MacDailyNews. As a token of our appreciation, we're offering you a limited-time offer of 20% off a paid subscript...

-

Apple, aiming push more urgently into the smart home market, is said to be nearing the launch of a new product category: a wall-mounted disp...

No comments:

Post a Comment