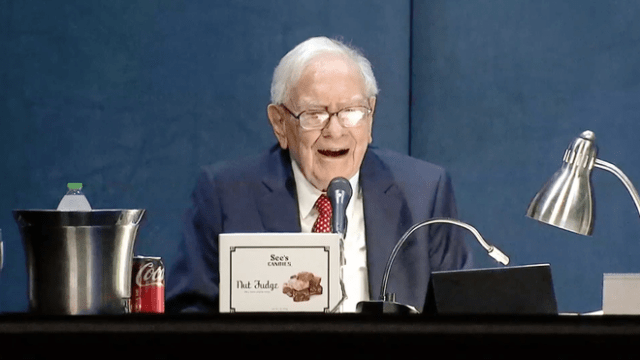

Berkshire Hathaway’s significant reduction in its Apple holdings is expected to result in a hefty tax bill. After selling over 600 million shares of Apple stock in the first nine months of 2024, including 100 million shares in the third quarter alone, Berkshire Hathaway is poised to be one of the largest corporate taxpayers this year. This strategic move by Warren Buffett’s company has sparked interest and speculation about the future of its investment portfolio.

We are currently about 1/4th of the way to being sustainable with Substack subscriptions. Not a bad start! Please tell your Apple-loving friends about MacDailyNews on Substack and, if you’re currently a free subscriber, please consider $5/mo. or $50/year to keep MacDailyNews going. Just hit the subscribe button. Thank you! You're currently a free subscriber to MacDailyNews. For the full experience, upgrade your subscription. |

Tuesday, November 5, 2024

Berkshire Hathaway’s tax bill on 2024 Apple stock sales: $20 billion

Subscribe to:

Post Comments (Atom)

Merry Christmas and Happy Holidays from MacDailyNews!

Dear MacDailyNews readers and commenters, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Substack is covering the cost of your first paid month of MacDailyNews by MacDailyNews. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Apple, aiming push more urgently into the smart home market, is said to be nearing the launch of a new product category: a wall-mounted disp...

-

Thank you for reading MacDailyNews. As a token of our appreciation, we're offering you a limited-time offer of 20% off a paid subscript...

No comments:

Post a Comment