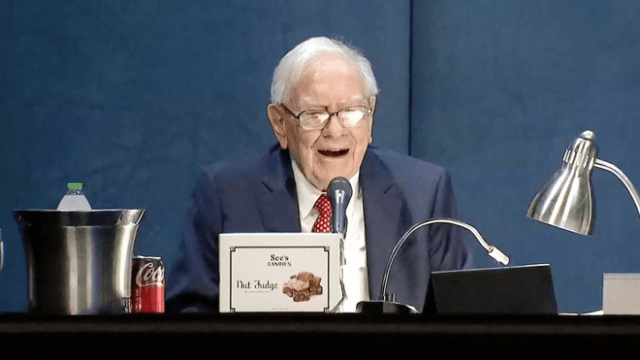

Warren Buffett’s investment firm, Berkshire Hathaway, substantially reduced its stake in Apple during the first half of 2024. According to regulatory filings, Berkshire has cut its Apple holdings by 55%. This move could have potentially cost the company a significant amount of money, as Apple’s stock price has risen by 10% since the end of the second quarter. If Berkshire had maintained its previous position in Apple, its stake would be valued at approximately $210 billion at current market prices. This suggests that the company may have missed out on a $23 billion profit opportunity by trimming its Apple holdings. Matthew Fox for Business Insider:

We are currently about 1/4th of the way to being sustainable with Substack subscriptions. Not a bad start! Please tell your Apple-loving friends about MacDailyNews on Substack and, if you’re currently a free subscriber, please consider $5/mo. or $50/year to keep MacDailyNews going. Just hit the subscribe button. Thank you!

Support MacDailyNews at no extra cost to you by using this link to shop at Amazon. The post Oops! Warren Buffett left $23 billion on table by trimming Berkshire’s Apple stake appeared first on MacDailyNews. You're currently a free subscriber to MacDailyNews. For the full experience, upgrade your subscription. |

Friday, October 18, 2024

Oops! Warren Buffett left $23 billion on table by trimming Berkshire’s Apple stake

Subscribe to:

Post Comments (Atom)

Apple debuts new ‘Quit Quitting with Apple Watch’ ads to boost New Year’s fitness motivation

As 2025 draws to a close and millions gear up for 2026 New Year’s resolutions, Apple is rolling out a fresh series of motivational advertise...

-

Substack is covering the cost of your first paid month of MacDailyNews by MacDailyNews. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Apple, aiming push more urgently into the smart home market, is said to be nearing the launch of a new product category: a wall-mounted disp...

-

Thank you for reading MacDailyNews. As a token of our appreciation, we're offering you a limited-time offer of 20% off a paid subscript...

No comments:

Post a Comment